Early Stage Advisor Playbook

The why, how, and what of early stage advising

TL;DR

Taking on advisory positions at startups can be rewarding on many levels. Consider the dimensions of financial upside, potential learnings, potential connections, and potential future job opportunities. To build a funnel be out there and vocal about being available to advisory roles. Use existing contract templates and frameworks to ensure not taking advantage of hard-working entrepreneurs. Be a thoughtful and humble advisor. Take money off the table when you can.

This post is relevant for those of you who want to get into advising startups. While a lot of the why and how is relevant to any stage advisors, I will focus on early stage advising in particular.

Why Advising?

Building startups is hard. Tapping into wisdom of people who have done it before is invaluable. Being an advisor is about providing some of your hard earned and relevant expertise to founders. There are financial upside, learning, job opportunity and self-actualisation reasons that make this a worthwhile pursuit.

From an economic perspective being an early stage advisor offers you the opportunity to spin the wheel of startup upside fortune without having to commit your life to one company. If you pick the companies well (lucky), you can earn significant upside. For those startups that make it, a 30x from pre-seed to first liquidity event is a realistic (yet rare) outcome. Say you get options worth 10k at a 5 million pre-seed valuation. A 30x means pre-tax earnings of 300k (minus option strike price costs) if the company makes it to a 150 million Series B. Given the crappy odds of success we’ll have to think a bit more about the risk reward side of this calculus later in this post. Building up a portfolio of private company equity through advisory work is a capital efficient way to have exposure to a risky but potentially very rewarding asset class.

As an advisor you bring functional or sectoral experience but will also gain invaluable applied experience. Most recently I’ve had front row seats to AI both on the image generation and LLM side. This type of exposure and learning is worth a lot, probably more than my advice is. It is also valuable to learn what does and does not work in other early stage businesses, if you currently (or in the future plan to) work in a startup. What tools are all the rage, what’s the best platform to spend ad dollars on as a B2B SaaS company, which recruiters do a good job, etc. are all important questions you can crowdsource from entrepreneurs, including those who you advise.

Advising is a good way to try before you buy. Often joining a business in a senior role at an early stage company is a big leap of faith. The entrepreneur is likely not willing or able to share as much info about the business as you will need to feel 100% convinced about joining. Becoming an advisor allows you to get a sense of the metrics and experience the work ethic as well as personalities of the team before you commit to joining.

The self-actualisation part of advising is a bit more fluffy. Whether imparting wisdom floats your boat, is an individual thing. For me, leveraging my experience to accelerate someone else’s journey is very fulfilling. So much so that even if most of the startups I advise fail, I’d still be winning. Being an advisor especially at the early stage of a business means partially being a mentor, coach or confidant. There is a lot of emotional turmoil and rejection that one needs to overcome for a business to become successful. Supporting someone through this journey is sometimes intimate and will likely be a path to a long-term friendship.

How to Build a Funnel

So how do you find these advisor opportunities? There are many roads to Rome. Useful content is a good way to establish your expertise visibly and gain exposure to potentially new entrepreneurs who are not within your network. It is also a great way to create your own particular brand. Leveraging your existing network is another obvious path. Finally, Angel investing can also be a great channel to find gigs.

Think of your advisory services as an opportunity to create a diversified product. Setting up a brand that sets itself apart from others is a good way to cut through the noise. How and what you communicate are the way to set yourself apart. By now you’ve caught on to the fact that I’m somewhat describing what I’m doing here with Startup Pragmatism. The tone in my case is rather informal and direct. The what is focused on more early stage lessons across the spectrum of operating, advising and investing. Pick your how and what so that you can be authentic in your communication. The way one can stand out in a noisy world is by being extreme or exceptional. The former is not a game I’m interested in playing the latter is hard and requires you to find your own voice. Choose your path.

The main platforms to get out there are LinkedIn, Twitter (X), Reddit, HackerNews, Substack, Medium, etc. Micro-blogging i.e. writing longer “Tweet length” insights is a viable path. I am a fan of writing longer form and distributing via channels. For this it’s advisable to build a mailing list that you can expand one interaction at a time. I usually ask people, who I meet in a business context, whether I can add them to my blog distribution list. Consider cross-posting and recommending other complimentary content creators to grow your audience. Writing value add content should get you new followers over time organically. You can optimise when you post etc. for the highest bang for your buck but in the end the most important rule in the content game is consistency of posting.

If you don’t want to play the content game (and I don’t blame you as it has become an inauthenticity oversharing race to the bottom) at least make sure that your various profiles explicitly signal that you are advising. Without putting the word out you won’t get any inbound. Therefore, make sure your LinkedIn and professional profiles give context about what type of advising you do and show off your existing engagements. These profiles are your storefront so design them thoughtfully.

Presumably you’ve built a network of business connections and investor relationships during your operational tenure. Put the word out there that you are looking for advisor jobs. Make sure you provide your network with a snappy blurb of what your unique selling point is so that they remember you when relevant. Mine is “Early stage commercial COO with nearly 2 decades of b2x experience. Always strategic and pragmatic. Raised more than 100 million.” Entrepreneurs network so make sure that the companies you are already advising put the word out, if they meet other promising startups that could use some help.

Another great way to get advisor opportunity flow is to join angel syndicates. Some of these networks have high quality deal flow and allow you to invest in companies with as little as 1.000 GBP. Once you are on a startup’s cap table and get regular updates you can engage with the company to offer help. If there is a good fit, you can formalise the relationship over time to become an advisor. I’m part of Ventures Together and it’s been an amazing network with some extraordinary deal flow.

How to Pick

This may not be a problem you will have initially but in general consider assessing advisory opportunities across the dimensions of financial upside, potential learnings, potential connections, and potential future job opportunities.

The dimension of financial upside is something I’ve mentioned earlier. The thing to consider here is what multiple can this startup still generate. Of course if it’s a paid engagement (I don’t do those as often) then the calculus is different. The likelihood of a liquidity event needs to be part of your assessment as well. Early stage startups have to pass a lot more hurdles to get to a place that you can take money off the table than a Series B business. In other words, consider comparing the risk reward ratios of two different opportunities with each other:

RR = R x (1-P)/P

COMP Ratio = RR1/RR2

RR = Risk Reward

R = Reward

P = Probability of failure

COMP Ratio > 1 = take opportunity 1

COMP Ratio < 1 = take opportunity 2

This is not an exact science but it is as close as you can get to look at things from a less emotional perspective. R is something you can figure out by looking at comps in the respective field (i.e. what have been say Seed to Series A multiples for HR SaaS tools recently). P is the brutal failure rate of startups that is well documented (roughly - pre-Seed/Seed 70-90%, Series A 50-70%, Series B+ 25-50%). Remember that liquidity events happen potentially around Series B. So your P is a factor of all the failure rates at different stages. If this was confusing, keep going. I’ll spend more time on this later.

An important factor for me personally are the personal growth elements that can come from both learning and connections that I am able to make because of the advisory position. The learnings are individual. As mentioned I’ve been advising various AI startups. This has allowed me to understand the technical underpinnings of the current technology and its limitations very well. One can also spend time learning about this personally but that doesn’t come with equity upside. If any of the desirable knowledge or skills you are seeking are available for you to pick up through an advisory engagement, it feels like a no brainer.

The connections you can make should also factor in. Primarily the question is, do you rate the team highly and will you want to build long-term relationships with these people. But also consider if the startup is creating a product with an end customer that you would like to engage with (e.g. startup builds a tool for VC funds). It will allow you to engage with said end customers, which can help you to build up a valuable network for the future.

Finally, contemplate if the company you are advising, might be a business you’d want to work for in the future once they are further down the product-market fit journey. If the answer is yes, advising is a great way to try before you buy.

Don’t Be a Douche

This subtitle speaks for itself.

The tech ecosystem prides itself for being a friendly place. I remember the naughts and teens of the London tech scene being a supportive and friendly place full of givers with a remarkable energy. It is true that a lot has changed since then (more snake oil merchants, egomaniacs and leeches) but compared to other industries tech still feels more supportive of strangers than other fields. Let’s keep this alive.

With that in mind, not every request by a founder or startup needs to be monetised. You can just pay it forward and do someone a solid. A couple of intros are not worthy of equity (even if it is to a VC). In general, the rule should be if you are spending a non-trivial amount of time on something or are repeatedly spending time on something it probably qualifies for a more formal arrangement. One offs don’t have to be monetised if they don’t require any of your time.

The flip side of this for entrepreneurs is to suggest potential remuneration proactively. Most people, who are in the position to advise, don’t like to bring up getting rewarded for something trivial. You can still provide them with value for their willingness to help. If you have a b2c business give them a free month subscription. If you have a b2b product maybe give them or their friends a discount for a month. I’ve been supportive of many startups that took the intro/help and never ever looked back. That feels kind of shitty. Don’t be shitty.

This rule obviously also applies once you have an advisory gig. On the advisor side, make sure that you live up to the expectations stipulated in your agreement. If you are repeatedly not, bring it up proactively and decide how you can rectify the situation. Don’t take on engagements when you know you won’t be able to do them justice. Also, don’t overestimate your impact on the business and therefore don’t negotiate aggressively with entrepreneurs.

On the entrepreneur side, don’t just rug pull an advisor. If something didn’t work out as intended suggest to adjust the equity or the ways the advisor can provide value. I’ve had a situation where I put a lot of effort into supporting a founder with a fundraise that didn’t work out. It wasn’t my fault but she turned around and cancelled my advisor agreement before I cleared the equity cliff stipulated in the contract. So I wasted many days of my life and reputation, without anything to show for. That was a bad experience. Needless to say I informed my network of this behaviour by the founder and have since been doing a lot more reference checks before I enter an advisory agreement.

The Paperwork

This is a contract that is established as the standard for advisory agreements. What’s good about using this is that you know that there is no funny business going on. Look through the details of it yourself. I will highlight two parts in particular vesting and equity compensation.

As mentioned in my bad experience above, vesting is something you need to consider well. At the very basic level vesting is there to ensure that both sides live up to their side of the bargain. Equity is not given out in one up front chunk for advisors but is allocated on a set schedule (similar to how employee equity works). There can be a cliff, which provides the entrepreneur with a trial period before they pay equity.

The standard cliff is 3 months and the standard vesting period is 2 years, during which the equity vests pro rata on a monthly basis. For the entrepreneur this means that at the 2 month mark you better communicate with your advisor and tell them if you are unhappy with the arrangement so they have a chance to step up. As an advisor this means you will have to trust that the entrepreneur doesn’t rug pull you in the first 3 months. It also means that you have to hold up your part of the bargain, if you want to pass the cliff and continue to get equity allocated for your work on an ongoing basis (5 day notice period to terminate by either side).

There are a couple of adjustments I make to the cliff. Sometimes I get rid of the cliff all together. If for instance a lot of my work is up front, then it does not make sense to have a cliff. I would rather provide the entrepreneur with references from folks I’ve worked with so they get the assurance they need to give me equity right away. This preferable to risk wasting my time. The other change is accelerated vesting when the main part of my engagement is about fundraising. In the case of a successful outcome, I then ask for 50% of the equity to be vested post money hitting the startup’s bank account. The reason for this is that I am usually very hands when it comes to fundraise engagements and spend many hours with the entrepreneur working holistically on story, strategy, data, pitch and outreach. So a lot of value is front-loaded, which is reflected in the accelerated vesting schedule. If you are providing the majority of your value upfront, think about adjusting the schedule (workshop, project work with upfront deliverable, etc).

Let’s talk about the most contentious issue: how much equity is your time worth? Remember first off that the likelihood that you will earn anything here is quite lopsided. A minority of your gigs will lead to any financial outcome and those that will most likely will be decent to meaningful. In essence, that means you don’t want to have a bad deal for those that are winners. This shouldn’t mean you negotiate every agreement to rinse the entrepreneur but that you should apply a consistent framework.

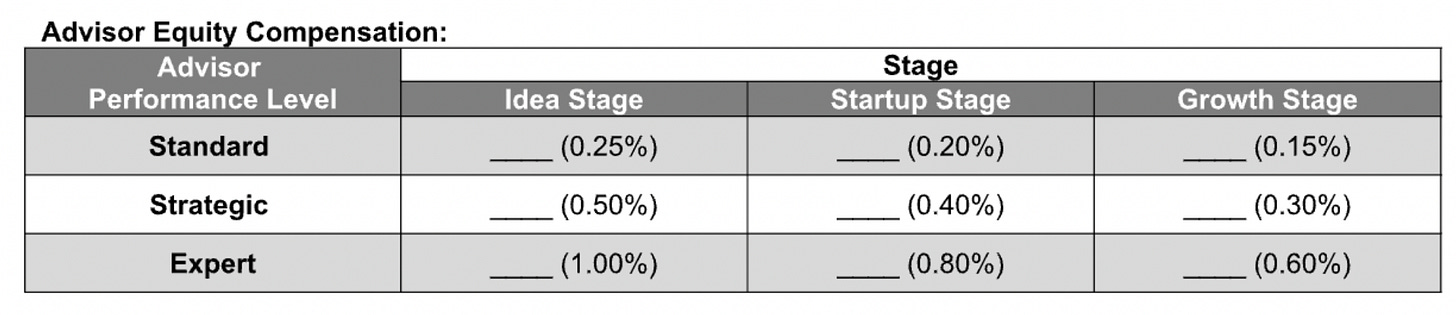

The table above which is part of the linked FAST agreement is pretty good benchmark to take as a starting point. I would redefine the stages to:

Idea stage = pre product up to early traction, no meaningful revenue (pre-Seed/Seed)

Startup stage = product hypothesis somewhat validated, good traction, some revenue, starting to test growth hypothesis (Seed/Series A)

Growth stage = product hypothesis validated, meaningful traction and revenue, nailing growth hypothesis to prove product-market fit (Series B+)

The levels (Standard, Strategic, Expert) on the advisor performance are useful but I don’t think the tier explanations in the exhibit make sense for all engagements. This is an art not a science but let’s talk about some of the elements that matter: time, relevant skills, relevant network, type of project work.

It’s simple to correlate time spent per month with a higher advisor tier. That said, that’s only part of the picture, as a high quality skill set and network can provide higher leverage with less time spent. If you and the entrepreneur feel that you have a uniquely useful skillset or network for the position, you should see yourself in at least the middle tier (if not in the top one). Skills means for instance technical ability, growth marketing chops, fundraising experience, etc. Network means for instance access to relevant required talent, strong target customers relationships, etc.

There is also a difference between being focused on a specific work product with a specific goal versus being regularly consulted on an ongoing basis. I often help with fundraises or specific business development deal negotiations. These are both time boxed projects so they might not neatly fit into the tiered framework. For these situations you have to come up with a custom percentage.

Let’s use some numbers to make sense of all this. Say you are going to advise a Seed startup at the Idea stage. You are planning to talk to the founder twice a month for an hour each and have relevant experience. The valuation of the startup is 5 million and you settle on 0.5% equity vesting over 2 years. In other words, 48 hours of work for 25.000 of equity value. We need to risk adjust this and take the potential upside into consideration to get to a more realistic number.

Value per hour = V = 25.000 / 48 = 520

PSeed = failure rate of Seed startups = 90%

PSeriesA = failure rate of Series A startups = 70%

PSeriesB = failure rate of Series B startups = 50%Vr = Value risk adjusted = V x (1 - P)

Seed adjusted = (520 x (1-0.9) = 52

Series A adjusted = (52 x (1-0.7) = 15.6

Series B adjusted = (15 x (1-0.5) = 7.8Va = Value actual = Vr x Val(future) / Val(current)

Va = 7.8 x 150 million/5 million = 7.8 x 30 = 234

Let’s assume your 25.000 stake will return 30x in a liquidity event at Series B. That’s 750.000 (pre-tax). However the likelihood of this happening is low - success rates at each stage need to be accounted for: (1-0.9) x (1-0.7) x (1-0.5) = 0.015. So the risk adjusted upside is 750.000 x 0.015 = 11.250. To get your hourly rate 11.250 / 48 = 234.

Of course, you can use slightly different numbers for failure rates depending on team and market. You can also adjust the upside multiple based on the sector and country benchmarks. Being conservative rather than exuberant is probably the best bet. However, all this is not meant as an exact science but a framework. Having an hourly number allows you to compare your various advisory engagements with each other and other real money (as opposed to potential future money) jobs.

A good way to think of the 234 number is that it should compete with potential expert network hourly rates that you can charge. Yes, mostly corporates use those services so the rates are usually inflated but they are a good guide. I’ve been paid anything from 200-600 USD per hour on expert networks so 234 would be at the lower end. Use this framework to know what a good target equity amount is for each different stage you get involved. You can also use it to figure out how much equity to charge for a 5 day workshop (assuming a desirable day/hourly rate).

How to Advise Well

This section should probably be a post on its own. That said here a not comprehensive list of things to keep in mind while advising.

First and foremost, align. Set expectations and ensure you are both on the same page as to what is required of you and the entrepreneur. Try to overdeliver regardless, as founders will thank you for it with liquidity or referrals.

Don’t watch the clock (also goes for the entrepreneurs). It’s natural that sometimes there is more need for help and sometimes there is less. This will all somehow balance itself out. If either side takes the piss, it becomes obvious enough to address.

I’ve had advisory agreements where the startup I’ve been helping has been so heads down that they didn’t need me for a couple of months. Once they had some results, they resurfaced and we spend 5 times the agreed upon time in a month digging through numbers. This sort of unpredictability requires the flexibility to sometimes talk super early or super late or on weekends, as you’ll have to accommodate for time you didn’t budget for. If this is not your jam, then ask yourself if advising early stage companies is for you. Later stage businesses are less stressed and more organised, so you’ll likely not run into this sort of randomness.

Build a relationship rather than being transactional. If shit hits the fan, pick up the phone. If there are issues, be more present. This stuff is fun for me, because ultimately it makes me feel I am part of creating something, even if my contribution is minor. More importantly, I am building long lasting friendships, which can be rewarding in ways one can’t anticipate from the outset.

Remember that you are not actually doing any of the work. This means that you should be humble about your opinions and careful about how you express them. Entrepreneurs, who are executing hard, sacrifice a lot so what they don’t need is someone giving them crap for messing up. Be a supportive listener that uses the Socratic method to get to the bottom of issues.

There will be moments when you know better. Provide anecdotes or case studies of other startups and your own experience that have been successful using the strategy or tactic you are advocating for. It’s good to show practical applications of ideas.

Be proactive, and be on the look out for useful things to ping over to the founder - articles, relevant events, potential candidates and most valuably, potential BD or partnership opportunities. You soon find out if they value them, and occasionally you will strike gold. Always use double opt in for any intros (thanks Dan).

Be in the weeds. Most startup advice in most videos and blog post is saying the exact same thing. The valuable advice is the one that is applied to the specific circumstance and context of the startup. This requires digging deep into the metrics, team dynamics, customer feedback etc. to find out what is going on. Your pattern recognition will pick up other signals from the noise than that of an inexperienced first time entrepreneur.

Make sure you know what the next company milestones are and provide feedback on whether they are the right ones to focus on. Check up on progress on those milestones during your meetings (without being annoying). Try to channel the best self of the entrepreneur and hold them accountable to their own ambitions (without being annoying).

If it is within your remit and you have access to burn and cashflow, be the voice of reason that advocates for frugality and responsible cashflow management. No more money, means a dead company and no more upside for you or the founder.

If an employee at the company is bad but the entrepreneur doesn’t see it, bring it up, if you feel it is appropriate. If it isn’t, introduce the founder to someone who does that job really well and let them figure it out by themselves.

Know your industry stuff and learn about the competition. Stay on top of trends and memorise metrics of the business. You don’t have much time together so having to catch you up for half the session until the advice can start is frustrating for the founder.

Sometimes just be emotional support and pick them up by giving them a positive perspective on things. This startup thing is a hard slog and by all measures a stupid thing to do but so much fun. On those bad days, all that is required is someone with experience that reminds you that the rollercoaster also goes back up.

Liquidity

I’ll keep this section short: TAKE MONEY OFF THE TABLE WHEN YOU CAN

.

.

Series B startups still have a 50% chance to fail. If there is a liquidity event, take money off the table. These opportunities to sell are rare and this startup thing is a gamble so don’t be a degen. How much you can sell, is not up to you. How much you should sell, if you have abundant allocation is up to your risk appetite. Some multiple of your principal would be sensible.

Also remember it is not at all guaranteed that you will be able to participate in a liquidity event. Say a founder has managed to negotiate as part of a Series B fundraise to have a secondary sale (existing shareholders selling equity rather than creating new shares). They will have a limited allocation. First the founders will want to sell themselves, then they will want to offer some up to the employees, then some funds may want to realise some of their gains (yes at Series B! you’d be surprised), then it’s time for angels and advisors. If the startup has many angels and advisors, then it is guaranteed that not everyone can participate at all or meaningfully. This means you want to be top of mind and an MVP (most valuable player) so that you make the cut (this also applies to angels).

Conclusion

Advising startups, especially at the early stages, presents a unique opportunity. It's not just about the potential financial gains through equity, which, though risky, can be significantly rewarding. More importantly, it's about the personal and professional growth that comes with it. Through advising, you gain invaluable insights into the latest industry trends, expand your network, and experience the gratification of mentoring burgeoning entrepreneurs. The journey of a startup advisor is as much about imparting wisdom and guidance as it is about continuous learning and relationship-building.

To excel in this role, it's crucial to approach it with a balanced mindset. Understanding the nuances of risk and reward, and learning to evaluate opportunities judiciously, are key to making the most of your advisory engagements. This involves not just a keen understanding of the startup's potential and the market dynamics but also a thorough self-assessment of your skills and the value you bring to the table.

Moreover, remember that your role as an advisor goes beyond mere business strategy; it often extends into mentorship and emotional support. The startup world is as challenging as it is exhilarating, and your role in steering entrepreneurs through this landscape is invaluable. Maintaining authenticity, humility, and a spirit of collaboration will make you not just a successful advisor but a trusted confidant and potentially a lifelong ally to the entrepreneurs you guide.

In essence, being a startup advisor is a dynamic and rewarding role that requires a blend of expertise, empathy, and strategic foresight. Whether you're in it for the financial upside, the learning curve, or the joy of helping others succeed, the journey promises to be as enriching as it is challenging.

Omid, really thought through and comprehensive to get a grip. Cheers buddy:)

Thanks Omid, great post!