Employee Equity Design

Principles for effectively designing and communicating employee equity

TL;DR

Employee equity is a crucial tool to motivate and align the team. Having a strategic approach to distributing it that is guided by the principles of fairness and transparency is key. Communicating its value should be done by sharing number of shares and price per share for an understanding of the total value of the equity grant. Furthermore, conveying potential risk adjusted outcomes will empower the employee to understand how even in non-unicorn situations there is money to be made with equity.

It is often frustrating when one hires employees and they want to negotiate for a higher salary by sacrificing their proposed equity stake in the company. The chances of that equity making them "fuck you rich" is not high but it doesn't mean it is worthless.

I have personally participated in secondary sales as part of startups that have netted me substantial sums of money that are financing my whole startup investment strategy. Did the equity in those startups make me "fuck you rich"? No. But there are levels to success and where value is generated sustainably in a venture there will also be a value ascribed to the equity.

It is therefore really important to change the paradigm in people's heads around the value of equity and the potential upside. This is not an easy task but let's tackle it anyway. Note there is a lot of theory, which will become clearer in the example section of this post.

Equity Philosophy

Equity can very much be worth a lower salary. Here I presume as an employee you are able to survive on the lower salary and that you have done your due diligence that the outfit you are joining is legit and not some sort of clown car of a company. While this life is not about becoming rich, the most efficient way to those Benjamins is probably not salary. Equity appreciates passively while you are asleep. Equity appreciates as a group effort - even if you are slacking off (which you shouldn't). Capital gains is only taxed at 20% versus income, which depending on your circumstance is likely a lot higher (in the UK). There are EMI schemes that make taxes on employee's startup equity more efficient etc. Also if you are lucky, equity can go 30x after a few of successful fundraising events. Who's salary goes 30x?

On the provider side of equity, startups should be fair and thoughtful. There are unfortunately too many stories of companies where only the senior managers get equity and all of it is handed out in seemingly random patterns. Thankfully most startups I have recently seen provide equity to all full time employees (despite it being quite some effort). While they may not be programmatic about it, the mere fact that everyone gets to participate in the upside of value creation is commendable. It is worth remembering that an equity incentive system that leads to better alignment has a higher chance to lead to better outcomes.

Value of Equity

To not run into the issue I described in the intro of this post, namely that the generous incentive of equity is being undervalued by employees, we need to figure out a good way of communicating said value without being misleading. It is tricky to convey the value of equity because, firstly, it usually vests over time so it is not immediately accessible. Secondly, it can be expressed in a multitude of ways, which are complicated. Thirdly, the change of its value is not smooth and somewhat opaque. Fourthly, it is not part of a liquid market, therefore not immediately realisable.

You don't hand out equity in a lump sum transfer. It usually vests or is accrued over a period of time in a pro-rata fashion. This means that all expressions of value of equity should assume a fully vested position, while being transparent about the vesting structure. In other words, you want to tell people what the their whole stack is worth even if they may not have access to it right away.

The way the value of equity is expressed can be confusing at best and deceptive at worst. I've had some VC types suggesting that we should split our shares (there can be good reasons for doing that). This way we can give people big numbers of shares, because "that looks better". Seriously? Of course our monkey brain prefers big numbers but we can do better telling the value story than hoodwinking employees. But what should we communicate: numbers of shares, value per share, percent ownership, total value of equity stake, etc? We'll get into the weeds of this later on.

Equity appreciates as a step function. While public stock prices fluctuate seemingly based on real-time performance (yeah right!), equity in a startup gets reevaluated every time you are raising funds. So for 2 years your company may technically stay worth the same despite say 10x its revenue. This is the nature of early stage private markets. When you go out to fundraise and investors assess your company's value it can go 5x from one day to the next. After such value adjustments it is important to communicate with the team so they understand their new equity value.

Finally, startup equity is not liquid. Comparing it to public market stock doesn't really make it look very sexy. However, the illiquidity also comes with higher potential multiples comparatively (yes, I know, so does Nvidia stock). It is important to explain to employees that liquidity events occur (in case the company executes successfully) even before a potential exit scenario is achieved. At later stages (Series C+) there are also platforms that allow for employees to sell shares on secondary markets.

Irrespective of these complicating factors there are many examples to point to where startup employees have made decent or even life changing money. Owning part of the business you work for is a great feeling so long as you believe in the company, strategy and leadership. As a founder allowing for employees to participate in the value upside of the business you are building together is equally rewarding.

Employees Levels

To determine the right level of value you want to give to employees, you will have to develop an ongoing framework. This needs to be adjusted after each fundraise and will ensure fairness. The goal should be that if somehow every employee's equity stake would be leaked that all the decisions seem consistent. Whether people agree with the levels of equity you hand out is another matter.

To be consistent we want to make sure that every employee that comes in at a given level of experience should get the same equity. Let's simplify this and say we have 4 tiers - entry, mid, lead and c-suite. The beauty of a consistent model is that you can tell hagglers that your model doesn't allow for deviation. Now there can be exceptions but you better make those obvious so that everyone would agree with them in hindsight (superstar developer that ends up contributing 4x compared to others etc).

What you also want to do is to ensure that every employee that joins the company at the same level of risk of failure gets the same level of equity. Joining a Seed stage startup means a lot more potential to fail than a Series B startup so the risk takers should get more equity. This is why after every fundraise you can adjust the 4 levels above in terms of equity stakes that you hand out. The more multiples have being realised by the increase in valuation of the company the lower the potential upside for later stage employees.

Communicating Value

There are a couple of ways to express the value of startup equity. Percentage ownership is not a great way to convey the value. On it's own it's useless so you would also share the company valuation for it to make any sense. The problem is that every time you fundraise you issue new shares, which dilute the equity stakes of every shareholder. So you would always have to restate the ownership stake over time for everyone, which becomes an unnecessary calculation. C-level folks like to know the percentage ownership stake when getting an offer as it is used for benchmarking but beyond that use case it's not worth spending time on.

The better way is to communicate the value of the granted equity stake by giving out the number of share options multiplied by the value per share option. This gives us an easier calculus that can be updated along the way. Every time there is a fundraise the price per share option goes up reflected by the multiple of the increase in the company's overall valuation. This gets us around abstract percentage ownership and dilution shenanigans.

Side note: I mention the term share option because mostly companies hand out the right to buy a share as an option. Once you want to make use of that right you will have to pay the option strike price to buy the option. Why options? Basically it allows the company to give employees shares without them having to spend money on buying them. What is good about early stage share options (and usually until quite late into the lifecycle of a company) is that they are valued at a discount to the price that investor pay per share. HMRC allows startups to give discounts of up to 99% to their employees when the company is still at a very risky stage. In other words, a VC could pay 100 GBP per share while you would only have to pay 1 GBP per share option that you own. So yes, there is a cost to get your equity but it is usually nominal compared to its value.

Vesting Schedules

Why is there vesting? Shares vest so that employees have an incentive to stay with the company. If employees were to get a lump sum of shares on day one and quit on day two that'd be pretty annoying. The standard vesting schedule is 4 years long.

Vesting usually occurs in a pro-rata fashion. This means the total granted equity stake will be split up over 16 quarters (4 quarters every year times 4 years) and the employee will get 1/16 every quarter of their tenure. There are companies that want to incentivise employees to stick it out longer and change the equal distribution to something that is more back loaded e.g. year one 10%, year two 20%, year three 30%, and year four 40%. In a standardised market it's hard to do something exceptional if you don't have leverage (your company is hot shit). In other words, like for like as an employee I would prefer pro-rata. The back loaded distribution would have to give me a larger overall value if I stick it out for it to become more or equally appealing to pro-rata.

There is also a concept of a cliff in vesting. Prior to reaching a cliff employees will not own any of their equity. They will be vesting their options according to whatever schedule has been agreed regardless. The reason for cliffs is simply to prevent job hoppers to collect equity in many companies. It is also quite annoying to manage a lot of tiny shareholders in ones' company, so the concept of a cliff creates a minimum threshold to get on the capitalisation table of a company. Usually in a 4 year vesting cycle this cliff is cleared after 1 year. This means that before the employee hits their one year anniversary they have zero share options. Once they clear it they will own 25% (assuming pro-rata vesting) of their grant.

Top Up Grants

From a company perspective employees with tenure are usually worth more given their institutional knowledge, amassed industry expertise and credibility in the company. This is why the goal is to keep such employees aligned long term with the company's growth. 4 year and one day into the tenure of an employee they are fully vested and therefore feel less inclined to stick around. This is where top up grants come in.

In essence what you want to do is layer equity grants so that before the first one vests fully another one has already started to accrue equity for the employee. If you feel the employee is very valuable you could give them a new grant at their one year anniversary. If they start showing their strength later on you could give someone a top up at the second year anniversary. Whatever the system you want to ensure that these layered grants provide a long term incentive so that leaving is theoretically costly.

Remember that while we may give the same amount of equity to every employee of a given skill level and risk appetite upon joining the company, the top up grant is where you can reward performance that sets people apart from their peers. For instance, a mid level person may turn out to be a dud but an entry level person could be a high performer. You may want to reward the latter with a top up at their one year anniversary, while the former may not get a top up until year 3.

ESOP

Employee Stock Ownership Plans (ESOPs) represent the equity available to hand out to staff. Hold on you can't hand out as much as you want? Nope, because every time you hand out equity you are diluting everyone else on the capitalisation table. Therefore, what usually happens is that an agreed upon amount of equity is set aside for the ESOP around every funding event. It usually dilutes the existing investors and shareholders (i.e. out of the pre-money valuation) not the new ones that are investing.

You have to be fairly strategic about this pool, which is usually around 10% at every funding round. What I mean by that is that you should have a good idea how many employees you want to hire until the next funding event (when you can create a new ESOP). This way you know how much equity should go to each hire. Remember that different levels of employees require different levels of equity to be satisfied, so not every to be hired employee gets the same share of the ESOP.

To make matters more complicated, you need to determine which one of your employees should get top up grants to ensure they are incentivised to stick around. Those come out of the same ESOP. This means some strategic planning is required to get this right. Advisor equity also usually comes out of the ESOP but I will not take this into consideration now to not make things even more confusing.

Example Template

I've put together a sheet that you can make a copy of to play around with. Let me explain how it works (also see comments in the cells for more guidance).

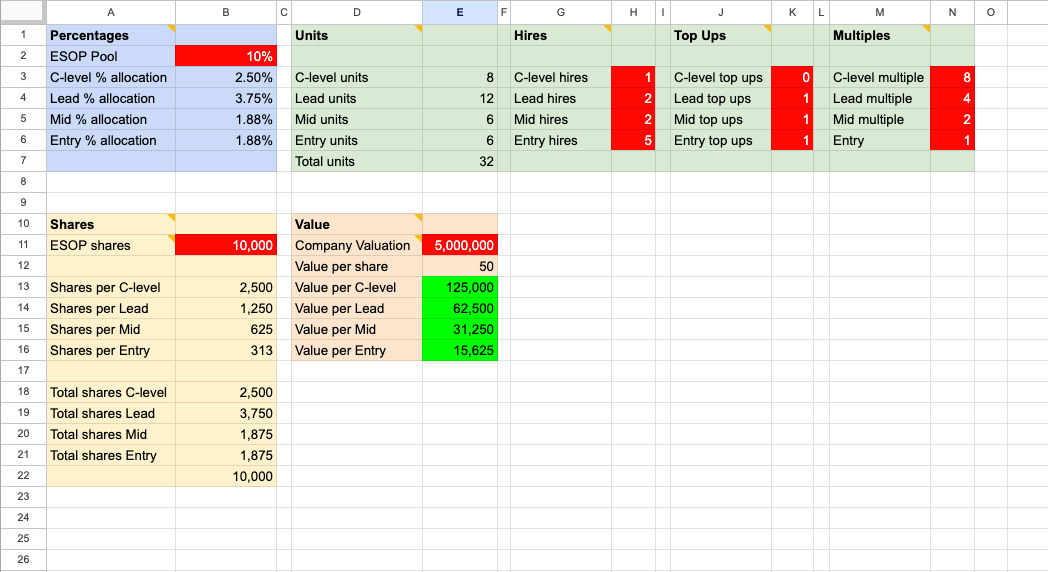

You start with the ESOP sheet. The first number to plug in is the size of the pool (B2). Also plug in number of shares this represents (B9) and the current valuation of the company (E9).

Now go to column N and figure out how you want to fill this out. Entry level employees represent one equity unit. You now have to decide how much more valuable different levels of employees are compared to an entry level person. I know that it's not koscher to reduce human beings contributions and value to multiples but if you have a better idea I'm all ears. In the example I'm suggesting a mid level person is 2x an entry person and a lead is 4x. A C-level is 8x. Once you start playing around with the sheet you will get a better feeling for the sensitivities of these factors and get a better sense of what is fair. I grant this is fairly abstract and of course an exercise in extreme generalisation but therefore also seemingly the most fair at the beginning when you are hiring someone with very little information about their actual performance.

Next you need to fill out column K and H. For this you need to consider a hiring plan until the next fundraise. That's how long the ESOP needs to last. You will also have to take a stab at how many people you want to give top up equity. This is obviously hard as this will be dependent on people's performance levels. With all these numbers you rather want to overshoot, because if you undershoot you will hand out bigger stakes and run out of ESOP. If you have remaining ESOP at the next fundraise it just gets added to the new pot.

Now column E will calculate how many entry level equity units are required by multiplying all the different weights. The sheet also now reflects the percentage granted per employee level and the corresponding number of shares (Column B). Look at Cells E13-E16 to get the equity value you are going to be able to give to each level of employee at this stage. To see how best to communicate this value go to the second work sheet Equity Communication.

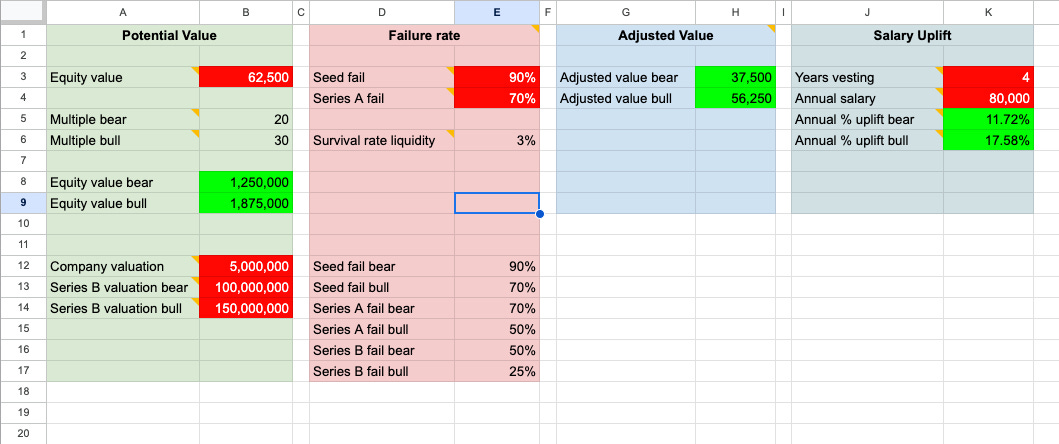

Enter the equity value into cell B3 (I've taken the lead level from the ESOP sheet). Fill in the current company valuation in B12. Look at some cases of Series B valuations in your particular industry. We pick Series B because if things go well, this is the first moment the whole team is likely to be able to take some money off the table in a secondary sale. Granted this will be an amount probably capped at 5-10% of their overall equity they have vested at that point but it is nevertheless the first time equity can be realised into cash. If the business survives of course! This is why we need to adjust the best case values we get in B8-9 by applying a risk adjustment. To do this pick failure rates to plug into E3 and E4. I've supplied the industry standards in E12-17. To get to Series B we need to survive a Seed raise and a Series A raise. (You can take the sheet to Series X by increasing the multiples in column B and adding more failure rates but I'll leave that up to you).

Column H will give you the risk adjusted equity value and if you add vesting time in K3 and salary in K4, you get a sense of the risk adjusted salary uplift that you can get from the equity grant. This number is not super impressive but it is essentially half a years salary up to 3/4 in this example. Is it really worth giving this equity up to haggle for 5k more base salary? Remember that in the best case scenario the numbers in B8/B9 come into play, which is worth considering. That likelihood is at 3% based on conservative industry standards (I used the worst failure rates). If your company has a lot going for it that percentage could be higher but the employee should be the judge of that. Ultimately, as a manager, who communicates the value of equity to an employee, it is prudent to stay conservative and this is what this sheet does. That said it is always worth pointing out that the whole goal of joining a startup is to realise cells B8/B9.

The last sheet (Vesting) is just an illustration of how layering grants works. It shows that if the value of a company multiplies, the vesting amounts of previous grants become more interesting. The equity that was previously vested will have also appreciated, which the sheet isn't showing, because it is giving a snapshot of the value of the shares in the moment they vested. This should give employees an idea how seemingly small grants can lead to big outcomes in good scenarios. It hopefully also gives the sense of how one can layer different grants on top of each other for higher long-term employee retention.

Conclusion

Employee equity design is complex but important. There are many decisions from the initial contemplation of how to deploy the ESOP to how to communicate the equity's value. These decisions can profoundly impact both the company and its employees. Equity, while not a direct path to insane wealth for every participant, holds the potential for significant financial reward and a deeper connection to the company's success. It is a financial representation of the relationship between a startup and its workforce, where success is shared and growth is mutually beneficial.

As startups navigate the process of equity distribution, the principles of fairness, transparency, and strategic planning are key. By adhering to these principles, you can create a company that can foster a culture of ownership and alignment, where every employee is invested in the collective success of the venture. This approach not only improves the company's potential for growth but also enhances the likelihood of achieving those very outcomes that turn startup aspirations into tangible multiples.

For founders and company leaders, the challenge lies not just in the mechanics of equity distribution but in effectively communicating its value. This communication is crucial in shifting the paradigm, helping employees see beyond immediate salary gains to the potential long-term benefits of equity ownership. I hope that this post and the spreadsheet provides a useful methodological approach to equity allocation and communication. The goal was to make this complex subject more tangible and understandable.

In conclusion, while navigating employee equity design requires careful consideration and strategic foresight, the rewards of getting it right are not to be understated. By valuing equity not just as a financial instrument but as a cornerstone of company culture and employee engagement, startups can unlock higher levels of commitment and innovation. In this shared journey towards success, equity becomes more than just a compensation tool—it can become a tool for alignment that unites a company and its employees in pursuit of a common vision.